- Home

- >

- BCI Forecaster Report: Australia (June 2023 – August 2023)

BCI Forecaster Report: Australia (June 2023 – August 2023)

Information utilised in this report is current as of 1 June 2023.

About

The BCI Forecaster is a leading monthly indicator of construction contract values hitting the market in the upcoming three months. Construction start values are presented Australia-wide, broken down by civil and building construction as well as by five key states and six key building sectors/project categories.

The short-term forecast is illustrated by contrasting the immediate three-month outlook against the previous three months. The longer-term trend is shown by contrasting the value of twelve months’ construction starts, ending three months out, against the corresponding 12-month period a year earlier.

The BCI Forecaster is an indispensable short-term planning tool, allowing decision makers to set realistic goals and parameters for their sales and operations teams.

Data is based on projects reported on a daily basis by BCI Central’s real-time project leads database, LeadManager.

Snapshot

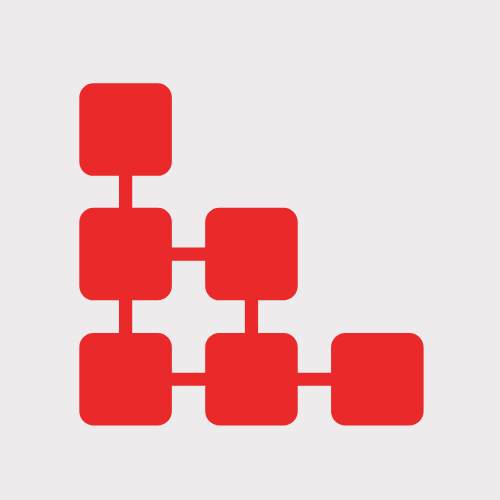

TOTAL CONSTRUCTION STARTS IN AUSTRALIA (MILLION $)

Outlook

As the tight labour market and high living costs contribute to the decision to increase wages, some analysts are bracing for even higher interest rate hikes to combat inflation. This remains to be seen until the June 2023 Reserve Bank Board Meeting regarding the monetary policy decision that will be implemented next. Meanwhile, the slowdown in consumer spending is being caused by a number of factors including higher interest rates and cost of living. With these persisting economic uncertainties, the RBA’s main priority remains to be the on-target management of the inflation rate. As the RBA tries to stir inflation into the 2-3% target range, the outlook for the economy is for a continuous growth that is below-trend. Given this, a gradual increase in the unemployment rate in the future is also predicted. In the construction market, construction starts remain stable at a short-term outlook of 9% and a maintained 1% long-term trend.

Building Sector

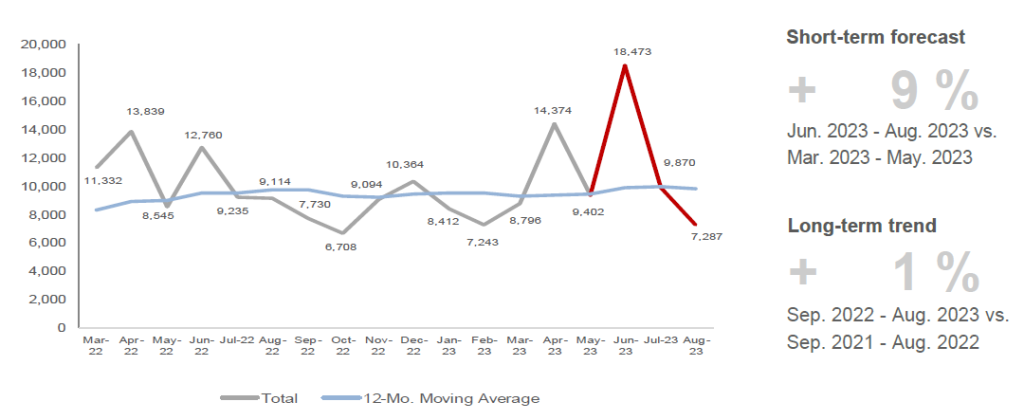

TOTAL BUILDING CONSTRUCTION STARTS IN AUSTRALIA (MILLION $)

Things are looking up for the residential sector in the short term, but the enduring trend shows below average values. It remains to be seen if the sector will recover in the near term, but in the meantime, the community sector is contributing more in terms of project value.

Notable projects from the community sector include the VIC projects, Hanwha Armoured Vehicle Centre of Excellence (HACE) (PID 270748017) in Lara, and the Melbourne Arts Precinct Transformation Project (PID 29198010) in Southbank.

Health projects in various locations are also figuring significantly in this edition’s reading, with hospitals such as the St. George Hospital – Stage 3 (PID 222172017) in Kogarah, NSW, the Shoalhaven District Hospital (PID 295993017) in Nowra, NSW, and the Logan Hospital Stage 2 (PID 306479017) in Meadowbrook, QLD.

Civil Sector

TOTAL CIVIL CONSTRUCTION STARTS IN AUSTRALIA (MILLION $)

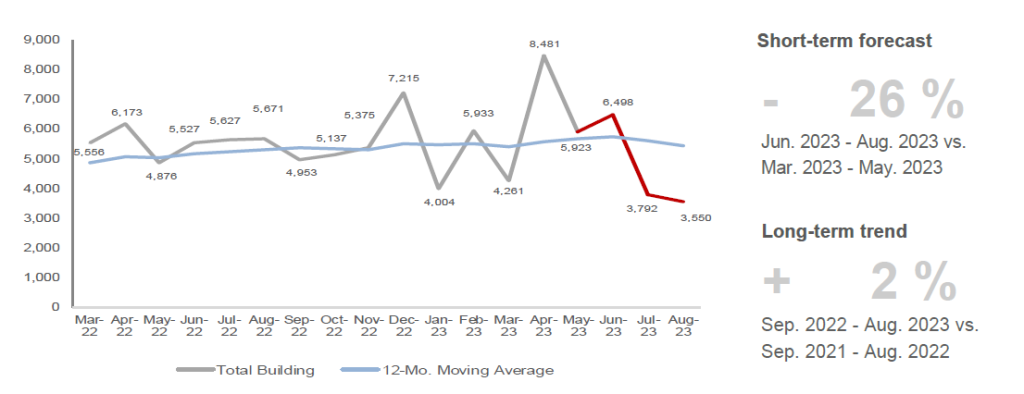

Civil construction starts continue to be largely influenced by the mega infrastructure project, Woodside/BHP Billiton JV – Scarborough to Pluto LNG Plant (PID 158751017) in Exmouth, WA.

Interestingly, contributions from the transport sector are more pronounced this quarter with the commencement of the Sydney Metro West TSE Works Package 1 (PID 256709017) and Sydney Metro West TSE Works Package 2 (PID 256717017) in NSW.

The near commencement of the Sydney Metro West Eastern Tunnelling Package (PID 256730017) and the Sydney Metro Western Sydney Airport Line – Rail Stations (PID 262491017) are contributing significantly to the transport sector total as well.

To view more data for building (residential, community, education, office, industrial, retail and hospitality) and civil (infrastructure, transport, utilities) construction projects, download a copy of our Australian construction industry forecast (June 2023 – August 2023).